- Green Rising

- Posts

- Greetings, humans. Where have you been all along?

Greetings, humans. Where have you been all along?

The G20 summit in South Africa is striving for new animal spirits in the natural world

Welcome to Green Rising – When world leaders meet next month in Johannesburg they will encounter a natural capital superpower.

Africa may not be a manufacturing giant. But when it comes to the bio-economy – the commercial use of forests, seas & fields – few have the continent’s potential.

The South African government, holding the G20 presidency, is unveiling a Bioeconomy Finance Hub to scale investments needed to build a thriving bio-economy.

Co-led by NatureFinance, a global non-profit, and the African Natural Capital Alliance, the hub aims to catalyse bio-economy investment. It will tackle historical barriers such as financial market failures, missing technical expertise, perceived high risks and measuring environmental impact.

The hub unites fragmented efforts in existence. The aspiration: By 2035, Africa will capture 50% of the final value of its bio-resources, a dramatic increase from less than 10% now.

This could position the continent as a key player in the global bio-economy, possibly worth over $30 trillion in the coming decades. But first, investors will need to discover what economist John Maynard Keynes referred to as “animal spirits”, aka enthusiasm.

How to define the bio-economy? “Commercial use of forests, seas and fields” captures farming, forestry and fisheries, but the bio-economy also includes microbes, biotechnology and bio-based processes (e.g., fermentation, enzymes, synthetic biology), plus valorising wastes and residues in biorefineries.

A detailed definition:

The bio-economy is the sustainable use of renewable biological resources—on land, in water, and at microbial scale—together with biology-based technologies to produce food, materials, chemicals, energy and services within a circular framework.

If you want a plain-English version:

An economy powered by living resources and biology-driven processes.

The World Economic Forum describes the bio-economy as the set of industries that sustainably use renewable biological resources, moving economies away from a dependence on fossil fuels.

The global bio-economy is already valued at up to $5 trillion.

China puts it alongside healthcare and energy strategies, aiming for global leadership by 2035. India’s bio-economy has gone from $10 billion a decade ago to $165 billion. The EU’s bio-economy represents 5% of its GDP today and 8.3% of its workforce.

But nowhere is the bio-economy as relevant as in Africa.

It represents a uniquely powerful opportunity. The bio-economy moves business beyond viewing nature as a passive resource. Instead, it can be an in-built competitive advantage (as well as a guarantor of good stewardship).

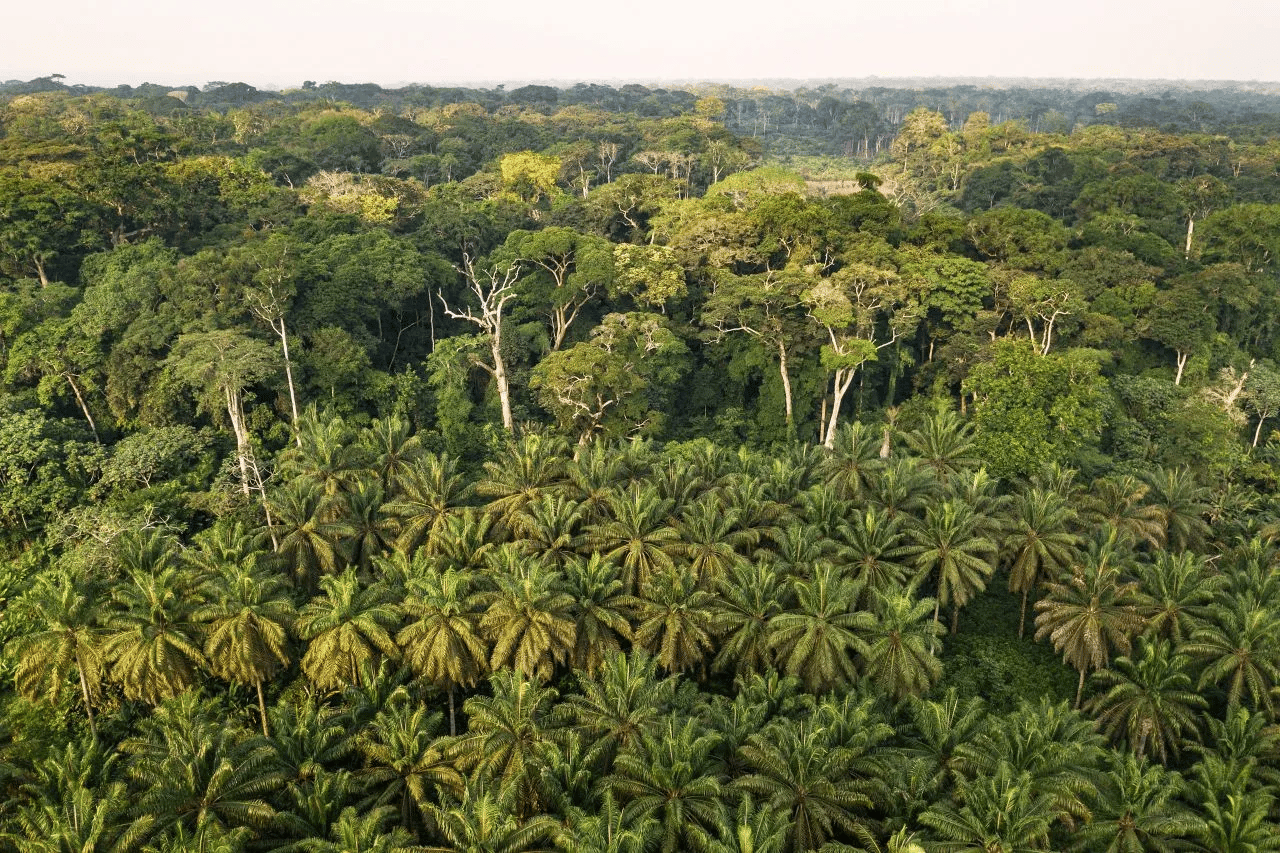

Africa’s biological endowments are immense and possibly unmatched in their totality.

The continent holds nearly a quarter of the globe’s arable land.

The Congo Basin acts as a critical net carbon sink for the planet.

Mangrove forests are powerhouses of "blue carbon" sequestration.

The World Bank suggests natural capital is the largest component of wealth for many African countries, often far exceeding the value of infrastructure and machinery.

Africa could use its biological resources to create home-grown prosperity. The bio-economy provides a pathway to industrialise, create jobs, stimulate innovation and produce goods for export. Done well, it could enable Africa to pioneer a new industrial model.

The African bio-economy is not a future concept. It is already taking root, driven by a wave of innovative enterprises turning biological resources into sustainable products:

Regen Organics (Kenya) — Agricultural & waste-to-value; franchise model using black soldier fly larvae (see above) to convert organic waste into high-protein animal feed and organic fertilizer; also produces clean fuel.

Kusini Water (South Africa) — Water technology; uses a bio-based filter made from macadamia nut shells to provide safe drinking water to communities.

Kelp Blue (Namibia) — Blue economy; pioneering large-scale deep-ocean kelp farming; underwater forests sequester carbon, restore marine ecosystems, and provide sustainable ingredients for agriculture and textiles.

Mawimbi Seaweed (Kenya) — Blue economy; partners with coastal communities to farm seaweed, creating a sustainable source of food and cosmetic ingredients while protecting marine habitats.

Hyapak (Kenya) — Materials & manufacturing; transforms invasive water hyacinth and agricultural residues (e.g., sisal) into biodegradable packaging, replacing plastic.

MycoHab (Namibia) — Materials & manufacturing; experimented with mushroom-based building materials—illustrates sector challenges while underscoring innovation in material science.

Giraffe Bioenergy (Kenya) — Sustainable energy; designs systems that convert agricultural and market waste into clean biofuel for cooking and heating, reducing waste and reliance on charcoal.

Brilliant Planet (UK-based; facility in Morocco) — Carbon removal & blue economy; operates a large algae-based carbon sequestration facility in Morocco, demonstrating the potential of high-tech bio-solutions.

Investment has started to flow. Novastar, a leading venture capital firm in Africa, embraces the bio-economy, backing companies like Afrigen (above), which pioneers messenger RNA vaccine production in South Africa.

If such businesses succeed, Africa’s natural world will benefit over the long term, and so will the (mostly non-African) investors. What about the population, rural as well as urban?

The African Natural Capital Alliance says the sustainable forest-based economy alone could be worth $1.5 trillion by 2050, creating over 25 million jobs. That gets the attention of political leaders.

.

Number of the week

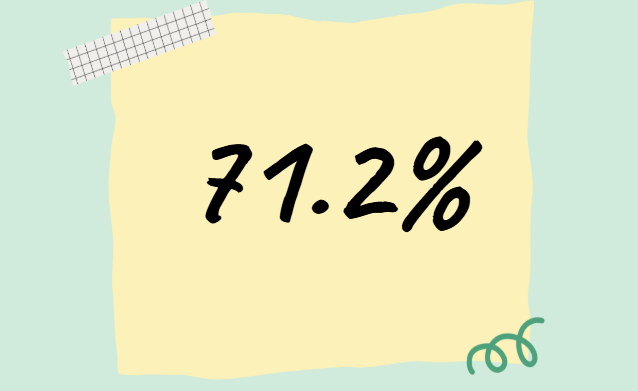

… of the Chinese electric cars imported so far this year went to four – but more likely three – countries in Africa: Ethiopia, Nigeria and Egypt. Djibouti also features on the list, but mostly for transshipping to landlocked Ethiopia. Together they’ve already imported 30,000 electric cars from China this year, a 122% increase over the same period last year.

Network corner

👉 Sun King teams up with Nigeria to localise the assembly of solar systems

What we’re reading

Nature’s dividend: Africa is increasingly paying attention to biodiversity bonds, attracting about $200 million in six months and expected to mobilize over $1.7 billion for ecosystem protection. Originating with species-focused projects like rhino and chimpanzee conservation, these outcome-based bonds now scale to landscape-level efforts, such as WWF’s $231 million initiative to protect five million hectares in South Africa. The Global Environment Facility’s $1.5 billion continent-wide project in 2025 signals rising confidence in this financial tool, which links investor returns directly to measurable conservation outcomes. (Conservation Rising)

Clean faith: Africa’s largest faith group, the Catholic Church, is accelerating solar adoption across its extensive network, partnering with Huawei to power over 4,000 institutions in Ghana and supporting EV charging in Kenya with Spiro. With 73,000 churches and thousands of schools and health facilities, the Church is addressing critical energy gaps in Sub-Saharan Africa. This trend highlights solar’s role in reducing costs, increasing reliability, and enhancing healthcare services. Coupled with its policy influence and community reach, the Church could play a pivotal role in Africa’s energy transition and decentralized electrification. (Renewable Rising)

Western wheels: It’s not just China selling EVs to Africa. The continent is also turning west for used electric vehicles, with US-based shipping firm Ship Overseas reporting a 37% revenue jump linked to higher demand for used EV shipments to Kenya, Ghana, Nigeria, and South Africa. Nearly 400,000 used EVs were registered in the US in 2024, making it a key source despite challenges like subsidy removals that may reduce supply. As African EV markets grow, used EVs are sold at lower prices than new models, with lower entry barriers, though battery degradation and limited local servicing remain obstacles. (Mobility Rising)

Reply